Both bond and stock traders were poised to react when the January Employment report hit the wires at 8:30 ET today. Who expected that it would take a back seat to other economic data and news?

I happened to be doing live media when the data was released, and I generally stand by my initial assertion that this does nothing to incentivize the Fed to adjust rates anytime soon. While Nonfarm Payrolls rose by only 143,000, below the 175k consensus, the two-month revision added 100k jobs to already robust results. The Unemployment Rate dipped to 4.0%, below last month’s 4.1%, which was also the consensus estimate. And to my mind, the most interesting part of the report was the unexpected rise in Average Hourly Earnings. Those were expected to remain unchanged at 0.3%, but they came in at 0.5%.

Thus, when we keep the Fed’s dual mandate in mind, we can postpone concerns that we are moving away from maximum sustainable employment, but remain vigilant that stable prices might not be a foregone conclusion. Fed Funds futures traders agreed, with the probability for a full cut moving from July to September, and the likelihood of a second cut in 2025 moved from about 75% to about 50%. Expectations on IBKR ForecastTrader also dipped.

Quite frankly, that shouldn’t have perturbed markets too much, and they didn’t. Remember our assertion that for the stock market, a stronger economy ultimately outweighs the need for rate cuts. A modest dip in rate cut expectations should not have caused too many concerns, and frankly, they didn’t. Stock futures dipped initially, but they had recovered all their losses and were on pace for another day of gains once markets fully opened. Bond yields rose modestly, from about 2-3bp higher to about 6bp higher across the curve, but those too were not concerning.

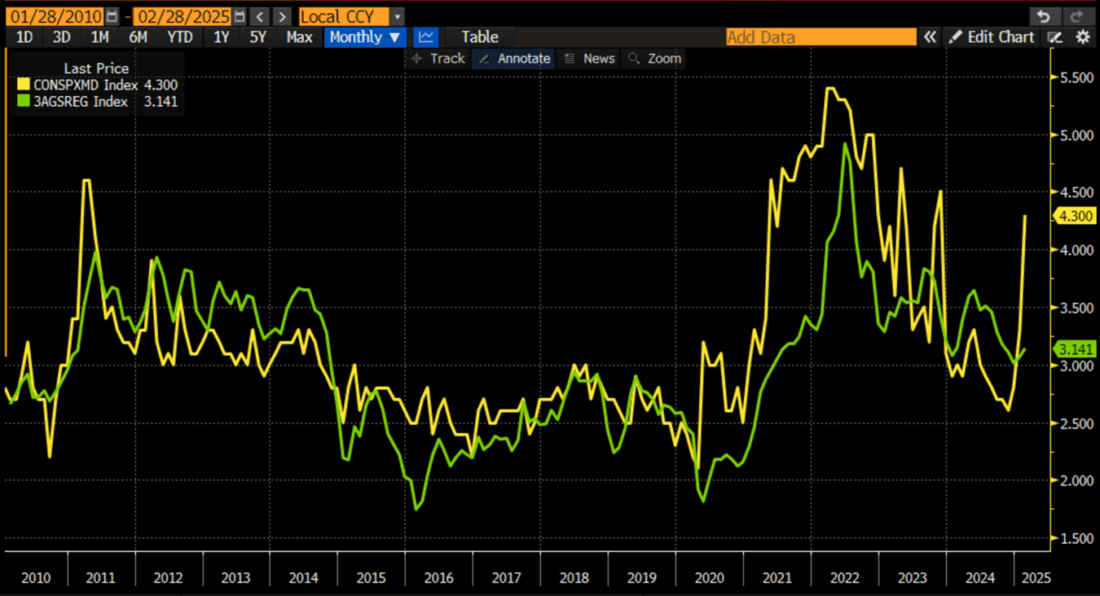

Then at 10am EST, we got a negative economic surprise. There is no way to sugarcoat the University of Michigan report. Sentiment plunged from 71.1 to 67.8 when it was expected to rise to 71.8. Meanwhile, 1-Year Inflation Expectations soared to 4.3% when they were expected to remain steady at 3.3%. So called “soft data” of this nature by no means indicate that stagflation is on the horizon, but they do reveal that something is concerning those surveyed – despite seemingly ample jobs and wages. For example, we have noted before that 1-Year Michigan inflation expectations generally follow gasoline prices. Instead, expectations soared despite relatively stable prices at the pump:

University of Michigan 1-Year Inflation Expectations (yellow) vs. AAA Retail Gasoline Prices (green), since 2010

Source: Bloomberg

Perhaps the subsequent piece of unfriendly market news could explain the malaise. Stocks plunged after a Reuters report that President Trump planned to initiate reciprocal tariffs as early as today. The President then made comments confirming that report during a meeting with the Japanese Prime Minister, without specifying the affected countries. Traders certainly shifted to a more “risk-off” footing, and the S&P 500 (SPX) was about -0.8% lower by midday.

Despite all this, traders continue to probe for opportunities to buy dips, as we can see in the chart below. Note the sharp drops when the Michigan data and tariff reports arrived, then the attempted bounces that followed. We can’t rule out either another attempt at a late rally, or perhaps a “sell the rumor, buy the news” move if the tariff announcement is more benign than feared. Either way, however, today’s activity points out again the volatility pitfalls that can sneak up unexpectedly during a busy news cycle. (Unless, seemingly, you’re trading Meta Platforms (META). That stock hasn’t had a down day in over three weeks! Magnificent indeed.)

SPX Intraday 1-Minute Candles

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.