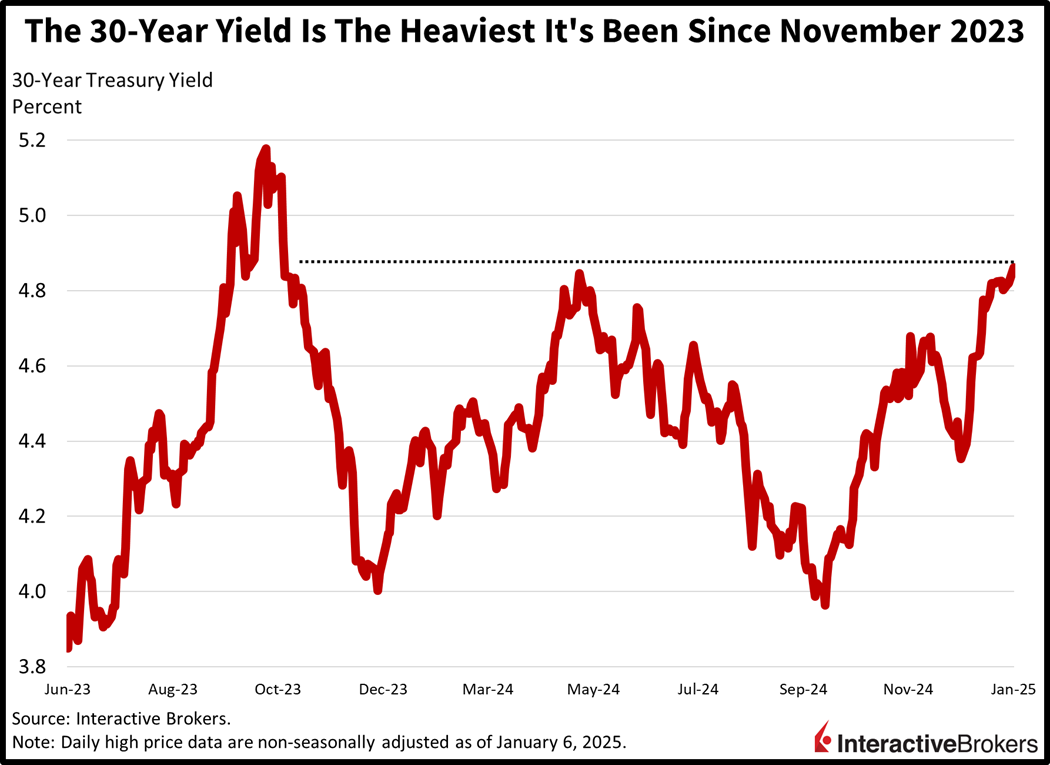

Stocks are jumping on rumors that the Trump administration may implement tariffs through a tactful rather than a blanket approach. The gentler position, as reported this morning by the Washington Post, is quelling concerns that Trump’s trade policies would be draconian and bolster inflationary pressures as a result. Later in the morning, however, President Trump denied any postural change and called the remarks incorrect, but the claims of a potential shift in proposed trade policies are still sending equities north and the dollar south. Separately, rates are remaining elevated due to fiscal imbalance worries ahead of bond auctions today, tomorrow and Wednesday for 3-, 10- and 30-year Treasurys totaling $119 billion. Similarly, the UK is issuing £6.5 billion worth of 5- and 30-year gilts this week, and the debt load burden is sending yields on longer duration bonds near the loftiest heights since the late 1990s. The US’s 30-year instrument, meanwhile, climbed to its heaviest level since November 2023.

Factory Orders Slip

US factory orders slipped in November as purchasing activity among nondurables failed to offset the weakness in durable goods. Factory orders have contracted in three of the past four months, with November’s transactions declining 0.4% month over month (m/m), beneath the -0.3% expectation and October’s 0.5% rate of growth. Transportation equipment, fabricated metal products and computer categories weighed the most on results, with revenues falling 3%, 1.7% and 0.5%. But primary metals, machinery and the electrical equipment segments offset some of the sluggishness as orders rose 0.8%, 0.4% and 0.4%, while furniture was unchanged. Purchases for nondurables increased 0.4% m/m, which wasn’t enough to counter the 1.2% drop in durables.

South Korea Leadership Conflict Escalates

Turmoil is continuing in the Korean Peninsula with escalating tensions below the 38th parallel associated with impeachment charges. In the north, meanwhile, the communist opponent of Seoul has tested a mid-range missile, calling attention to ongoing instability in the region. Regarding the southern country, officials failed to arrest President Yoon Suk Yeol, who faces charges of insurrection after declaring martial law, which sparked chaos throughout the country. Efforts to enforce a court order to detain and question him, however, were thwarted late last week by his supporters and armed secret service bodyguards. In response, police and the country’s anti-corruption agency are debating taking more forceful efforts to capture the former leader while Yoon’s supporters are reportedly implementing safeguards, such as adding barbwire enclosures around the impeached leader’s government residence.

Canadian’s Backlash Ends Trudeau’s Leadership

Canada Prime Minister Justin Trudeau has resigned as the head of the Liberal Party, a move that clears the way for the appointment of a new national leader. Trudeau, who has held the country’s helm for nearly 10 years, had lost support of his party and the New Democratic Party, which had formed a caucus with the Liberal Party. His polling results had tanked and his head of finance, Chrystia Freeland, sped up his demise by resigning and saying that she and Trudeau has significant policy differences. Additionally, his downfall is attributed to a backlash against immigration, the weak economy and efforts to curtail climate change. Against that landscape, the Conservative Party’s popularity is growing. The organization is calling for a quick resolution to the leadership vacuum as the country needs to brace for President Donald Trump’s proposed tariffs on imports from the country.

Stocks Ignore Trump’s Denial

Equities are still gaining strongly despite President Trump refuting the Washington Post news. The report cited anonymous sources stating that the incoming tariff policy would be pared back. But investors are in a buy now ask questions later mood, with all major, domestic stock benchmarks achieving gains. The Nasdaq 100, S&P 500, Russell 2000 and Dow Jones Industrial indices are advancing by 1.7%, 1.1%, 0.7% and 0.5%. Sectoral breadth is positive as 9 of the 11 segments climb with technology, materials and consumer discretionary leading; they’re up 2.2%, 1.1% and 1%. Investors are trimming the defensive utilities and consumer staples areas; however, those are losing 1.3% and 0.3%. Treasurys are trading in bear-steepening fashion, with the 2- and 10-year maturities changing hands at 4.28% and 4.64%; the former is unchanged while the latter is heavier by 4 basis points (bps). The greenback is recovering from earlier losses following President Trump’s denial, but it’s still down 56 bps and depreciating versus most of its counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders. It is appreciating relative to the yen though. Commodity price action is bullish with copper, silver, lumber, crude oil and gold up 2.7%, 1.7%, 1.4%, 0.6% and 0.1%. WTI is trading at $74.45 per barrel on the back of colder weather prospects that may curtail production.

Investors Plow Past Confusion

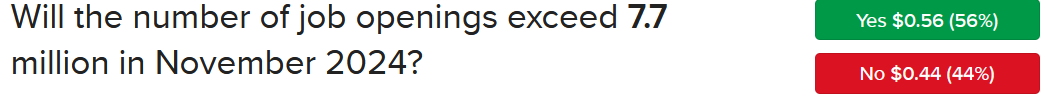

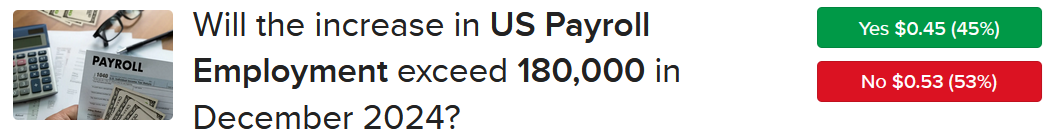

This morning’s confusion regarding President Trump’s trade policies is emblematic of the volatile news flow that is likely to persist during the next four years. Political posturing and a transactional attitude towards governance certainly generated back-and-forth perceptions on a multitude of issues ranging from trade, geopolitics, healthcare, fiscal matters, monetary policy and other developments during his first administration. But today’s trading action is looking bullish as far as stocks are concerned and investors have adopted a wait-and-see approach on tariffs, taking the good news of the early morning in stride, while neglecting the countering developments that occurred a few hours later. Meanwhile, traders are looking ahead to a busy week, which will be shortened in memory of late President Jimmy Carter. Folks are waiting patiently for this Friday’s nonfarm payroll report, which is likely to influence the Fed’s stance on monetary policy, especially since the committee has been highly attentive to labor market risks. But before that, we have job openings, ISM-services, Euro inflation, ADP-employment, unemployment claims, small business optimism, challenger job cuts and plenty of Fed speak. In conclusion, investors that are worried about incoming data releases can hedge their portfolios by purchasing forecast contracts via the brand new IBKR ForecastTrader.

Readers who are seeking real-time insights on the labor market can join me this Friday on X, formerly Twitter, at 8:00 a.m. as I provide a live presentation on the Jobs Report and associated forecast contracts. I hope you can join me.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.