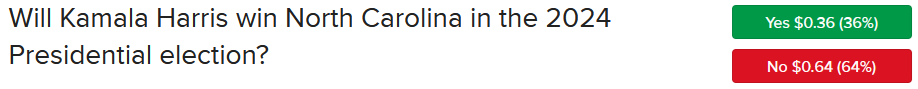

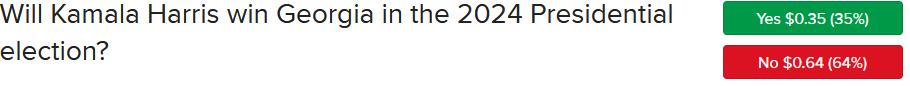

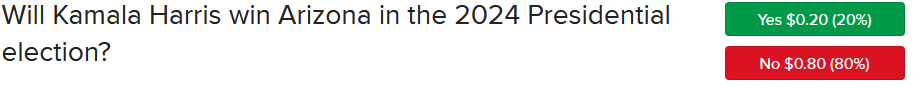

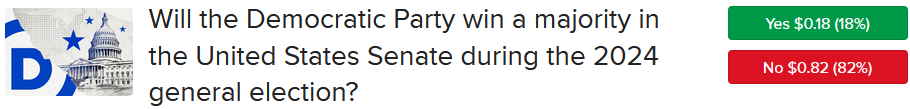

Stocks are buoyant on election day alongside rising probabilities of former President Trump reclaiming the Oval Office. Our IBKR Forecast Trader participants are currently assigning a 58% chance of 45’s return to the White House. The path for Vice President Harris is indeed narrower, as absent a major surprise, she can’t reach 270 electoral points without taking either Pennsylvania, North Carolina or Georgia, states where her opponent sports 61%, 64% and 64% likelihoods of victory, according to IBKR Forecast Contract players. To complicate matters further for the Democrats, Harris is also trailing in Arizona and Nevada by wide margins, essentially requiring her to post huge upsets in jurisdictions where she’s the longshot candidate. But GOP enthusiasm has decelerated in response to projections for Congress as investors in our marketplace now expect a split legislative body with Republicans claiming a Senate majority while Democrats flip the House.

Source: ForecastEx

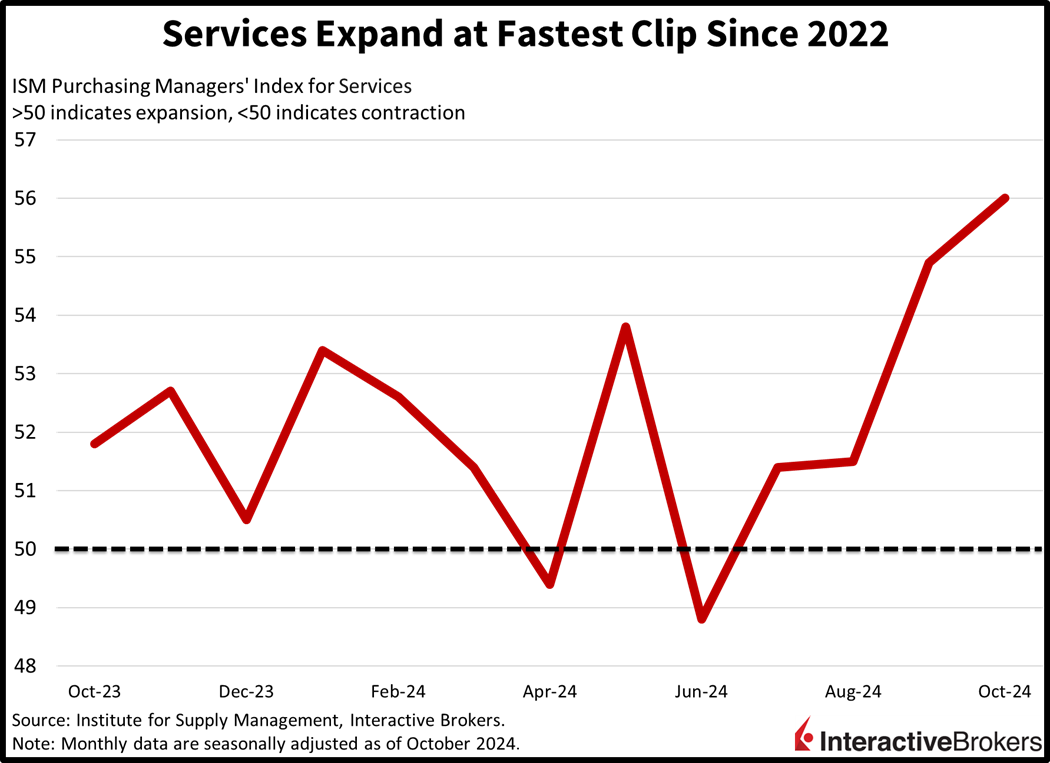

Services Accelerate Sharply, Boosting Economic Optimism

Services sectors, which comprise the majority of stateside economic activity, accelerated sharply last month, according to ISM’s Purchasing Managers’ Index. The Institute for Supply Management (ISM) benchmark strengthened from 54.9 last month to 56.0, the highest level since July 2022 and arrived well above the median estimate of 53.8. It is the fourth-consecutive month of advancement, signaled by a figure above 50. One noteworthy category was employment activity, which jumped 4.9 percentage points to 53.0. Analysts anticipated 48.1. After the number declined in September, employers said they are hiring to address attrition and holiday peak activity. Some commented that they are having difficulty with backfilling positions. The development is quelling concerns related to last Friday’s huge miss on nonfarm payrolls and is sending yields north. The following categories, while moderating, remained well above the expansion threshold:

- Prices continued to increase with a score of 58.1, but they climbed at a slower pace after September’s benchmark hit 59.4. October’s reading was still stronger than the 58.0 analyst forecast.

- Business activity decelerated from 59.9 to 57.2, which is still an impressive rate of growth, with some companies reporting that firms are planning to start the next phases of initiatives after the election.

- New orders also slowed slightly, dropping two percentage points from 59.4 and coming up short of the expected 58.0.

ISM-Services Sends Yields North

Equities are rallying with every major benchmark and sector in the green as Americans gear up to select candidates for office. The Nasdaq 100, S&P 500, Dow Jones Industrial and Russell 2000 are gaining 1%, 0.9%, 0.8% and 0.7% on the session. All 11 segments are higher, led by industrials, consumer discretionary and technology, which are up 1.4%, 1.2% and 1.1%. Treasurys are going the other way, however, as a stronger-than-expected ISM-Services report pushes up borrowing costs. Also weighing on interest expenses are the prospects of continued deficit spending in Washington, as the 2- and 10-year maturities change hands at 4.22% and 4.36%, 6 and 7 basis points (bps) heavier on the session. The dollar is weakening, however, with its gauge down 26 bps as the greenback depreciates relative to most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodity markets are robust, with silver, copper, crude oil and gold gaining 1.1%, 1.1%, 0.9% and 0.2%. Lumber is the exception, however, with prices declining 1.4% as mortgages above 7% hamper construction activity. WTI crude is trading at $72.28 per barrel on speculation that Riyadh may want to influence lighter supply in the coming weeks.

Strong Seasonals Favor Equities

Irrespective of who wins the presidency, strong seasonals favor stocks from now to year-end, especially since a blue sweep is not in the cards. The most likely scenario is a mixed Washington, with leaders on both sides of the aisle needing to compromise to get things done. But a red sweep is still possible, which will help equities via pro-growth policies that likely incorporate aggressive onshoring ambitions, lower corporate taxes and a subdued regulatory landscape. In conclusion, however, bond yields are critical to watch, as investors and traders alike examine the inflationary, deficit and activity impacts of incoming policies.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.