I’ve been frequently asked whether federal government policies are likely to have on markets. Considering that tariffs might be implemented as early as tomorrow, this is a critical consideration. Yes, policies will be critical, but not necessarily in the way that we might be currently expecting. Frankly, while many investors are understandably excited about the potential benefits of lighter regulation, they are not focused upon the potential negative effects to the economy of slower spending.

I know that some of you will inevitably interpret this piece through a political lens. I assure you this is not written with a political viewpoint in mind – my attempt is to stick to the potential economic effects of government policy on markets. Please be mindful of that while you read.

I believe that the role of fiscal stimulus as a force powering both markets and the economy (they’re not necessarily one and the same) has been underappreciated. Sure, we’ve all discussed the role that the various stimulus packages played in stoking inflation, but I believe that we’re still seeing beneficial economic results from them as well.

It is important to remember the direct role that government spending plays in the calculation of Gross Domestic Product, or GDP:

GDP = Consumption + Investment + Government Spending + Net Exports

Or

GDP = C + I + G + (X – M); where X= exports and M= imports

Although yesterday morning’s preliminary 4Q real GDP was reported at 2.3%, less than the 2.6% expectation, it is still pretty solid. It got a boost from a 4.2% jump in personal consumption, which would not have occurred if people didn’t feel that their own economic prospects are healthy.

Bear in mind that a good portion of the spending in the most recent package, the Inflation Reduction Act was in fact investment related because funds were allocated to infrastructure development. We reward companies for capital expenditures that have the promise of boosting future prosperity; we should do so for the government too.

Elections bring changes, and the key policy changes that the new administration promises include different approaches to government spending and net exports. The new administration asserts that spending is too high and needs to be curtailed. Without debating the politics of that statement, it should be clear that curtailing government spending would flip fiscal policy from expansionary to neutral or even contractionary, reducing “G” in the equation above.

Now, we also know that the new administration prioritizes increasing net exports, with tariffs as a key tool towards that goal. The effect upon GDP will ride upon whether the shrinkage in the “G” can be sufficiently offset by increasing “X” and/or reducing “M”. If yes, then the economic effects might be minimal or beneficial; if not, the US economy could suffer.

Some might be thinking that a weaker economy is OK if it brings rate cuts. But the equity market ultimately prefers a solid economy to one that is weak enough to require aggressive rate cuts. Remember, at this time last year expectations were for 7-8 rate cuts in 2024. We got only 4, and the first two didn’t come until September, yet the markets didn’t really care. Why? Because the economy was strong enough that aggressive cuts weren’t immediately required.

And we rallied in late 2022 and early 2023 despite rate hikes. Why? Again, because the economy was strong enough to overcome that drag.

And it’s not even clear that the bond market, which should relish slower spending, is fully on board with it either. If they were hopeful that spending cuts would reduce deficits and/or economic activity, then Treasury yields should have fallen. While yields are off their highs, 10-year notes are currently yielding over 10bp more than they were prior to the election. Bond traders have other concerns besides GDP though, and the higher yields also might reflect concerns about the budgetary effects of potential tax or tariff policies as well.

In short, there is a wide range of economic uncertainties that could affect markets in the coming months, and while the policies might be difficult to predict, the interaction between those potential policy changes is even more uncertain. Thus, economic policy initiatives will be critical for the economy and the markets, and their effects might be unpredictable. And of course, Chair Powell refrained from offering his opinions about them during Wednesday’s press conference. The Fed never likes to comment upon potential fiscal policies, particularly when they have yet to be fully decided.

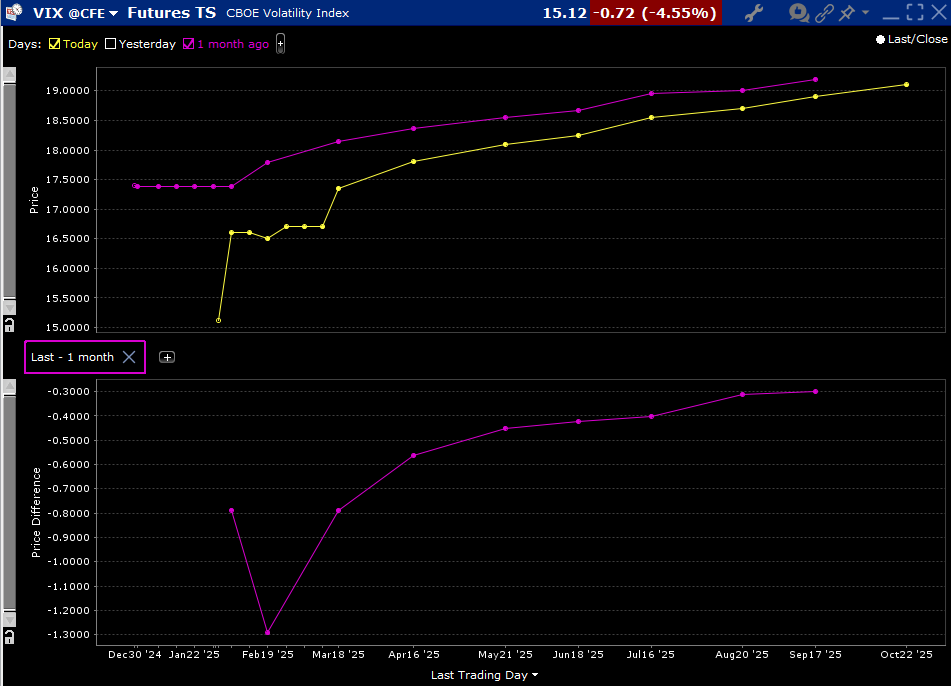

Yet the VIX futures curve seems rather unperturbed, both in the present and future….

VIX Futures Term Structure, Today (yellow, top), 1-Month ago (purple, top); Differences (bottom)

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.