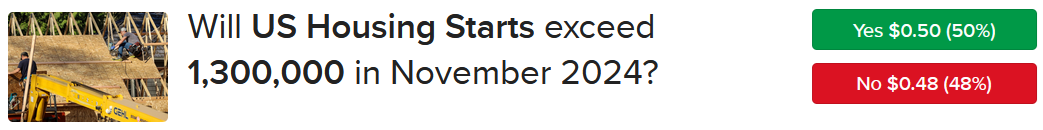

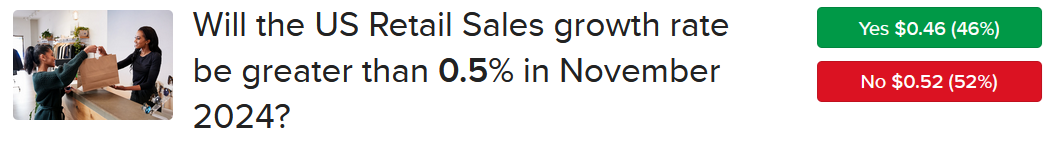

Markets are advancing to start the week as optimism concerning the Fed’s walk down the monetary policy stairs coincides with stronger-than-expected economic data. But it isn’t just the US due this week, as central banks in London and Tokyo will share their interest rate decisions and outlooks for the year ahead. Meanwhile, our IBKR ForecastTraders are gearing up for upcoming stateside contract settlements on retail sales, housing starts, building permits, initial unemployment claims, GDP and consumer sentiment, while Hong Kong’s CPI is also due this week. Turning to the economic calendar, flash PMIs from the EU and US depicted growth in the services sectors amidst contraction in manufacturing. However, a wrench was thrown into the European economic outlook a few hours after the report, with the German Parliament enacting no confidence votes against Chancellor Olaf Scholz and fast forwarding the country’s election to this February. And despite the weakness in manufacturing, the US economy accelerated strongly, thanks to services consumption.

US Services Sector Soars

Stateside economic growth accelerated this month even as the good-producing sector continued to contract, with S&P Global Flash Purchasing Managers’ Indices (PMI) hitting 48.3 and 58.5 for manufacturing and services. Manufacturing fell from 49.7 in November and missed the analyst expectation of 49.8 while the services benchmark climbed from 56.1 and substantially outpaced the analyst consensus expectation of 55.7. The contraction/expansion threshold is 50.

The surge in the service sector pushed output to a 33-month high while new orders rose at the sharpest speed since April 2022. Sentiment regarding the 12-month outlook for the business environment climbed to a 30-month high on expectations of the Trump administration improving conditions. Employment, furthermore, increased for the first time in five months but was up only marginally in manufacturing. Survey respondents noted that resolving uncertainty about the presidential election has supported sentiment.

While input costs among manufacturers increased, inflation on a broader level eased and average prices for goods and services rose only modestly. Manufacturers experienced increases in raw material prices, a result of higher shipping costs and increased demand as companies attempted to stock up in input items prior to any new tariffs. Goods producers continue to suffer from the headwinds of weak domestic and export demand, a result of lofty financing costs and elevated charges.

Europe Manufacturing Contraction Persists

Eurozone manufacturing is continuing to languish with its December rate of contraction matching the preceding month’s while the services sector has unexpectedly jumped into expansion, according to this morning’s HCOB Flash PMI report. The unchanged manufacturing PMI result of 45.2 fell below both the expectation for 45.3 and the contraction and expansion threshold of 50. It marks the 21-consecutive month of contraction. Manufacturers’ purchasing fell by the largest amount of the year and inventories of purchases and finished goods also shrank. Businesses depleted inventories at the fastest pace since July 2021. Manufacturing costs continued to decline, but only marginally. Companies continued to lay off workers for the fifth consecutive month. Most of the weakness occurred in Germany and France, a result, in part, of political turmoil.

Conversely, the services category climbed from 49.5 to 51.4. Analysts expected the result to remain unchanged from November’s reading. For service providers, input prices increased at the fastest pace in four months and output prices increased at the briskest rate since August. Inflation was driven, in part, by companies passing higher labor costs to customers. Unlike in manufacturing, service sector staffing was unchanged. Overall business confidence improved slightly but remained below the long-term average. It increased the most among service companies. Despite services beating projections, demand contracted similar to manufacturing.

ECB Likely to Ease

The European Central Bank anticipates that it will continue to lower interest rates, in part due to the threat of US tariffs clouding already weak prospects for the region, according to comments this morning from the organization’s president, Christine Lagarde. Services sector inflation has been driven by higher labor costs, but Lagarde says the central bank forecasts wages will rise only 3% in 2025, compared to 4.8% this year. Additionally, economic growth has been below what the bank has expected, so additional rate cuts may be appropriate if inflation continues to decline toward 2%.

Retail Sales Weaken in China

China’s efforts to boost domestic consumption hit a rough patch last month, climbing only 3% year over year (y/y), the weakest showing in three months. The anemic sales growth declined from 4.8% in the preceding month and was considerably weaker than the 4.6% level anticipated by analysts. While China’s subsidies of appliances and cars resulted in 22% and 6.6% y/y increases, respectively, overall retailing was weak. Cosmetics, for example, dropped 26% y/y.

Stocks Rally

Stocks are climbing as strong seasonals, anticipation of a friendly Fed and incoming pro-growth policies propel investor sentiment. All major, stateside equity benchmarks are higher with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial indices up by 1.1%, 0.6%, 0.4% and 0.1%. Sectoral breadth is similarly positive with 8 out of 11 segments trading north and being led by consumer discretionary, communication services and real estate, which are gaining 1.2%, 0.8% and 0.5%. Meanwhile, energy, materials and financials are up 1.2%, 0.3% and 0.2%. Treasurys and the dollar are near their flatlines, however, with the 2- and 10-year maturities and the greenback’s index changing hands at 4.25%, 4.41% and 106.92. The US currency is appreciating relative to the euro, franc, yen, yuan and Aussie and Canadian tenders. It is depreciating versus the pound sterling, however. Commodities are tilted bearishly, with lumber, crude oil, copper, silver and gold losing 0.6%, 0.5%, 0.2%, 0.1% and 0.1%. WTI crude is trading at $70.10 per barrel as Beijing consumption data weigh on the demand outlook.

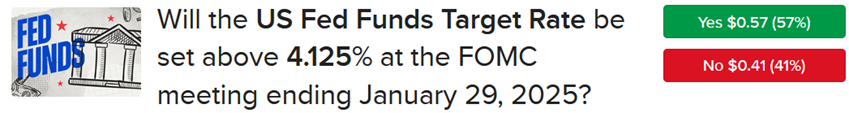

IBKR ForecastTraders Expect Cut, Then Pause

The Fed’s decision on interest rates and accompanying Summary of Economic Projections will occur this Wednesday and investors are eager to hear about the committee’s thought process on next year. The backdrop, which features recent problematic inflation readings, an uncertain fiscal landscape and precariousness on the trade and geopolitical front, is certainly confusing. Market participants will be cautiously waiting for any clues on reductions for next year, plans for the balance sheet and the central bank’s opinion on what the neutral level is. The messaging will also be paramount and largely dependent on Chair Powell’s tone. A dovish pitch will likely lead to a continuation in the Santa Claus rally while a hawkish delivery, emphasizing caution, may generate some hesitation in markets and hamper financial market exuberance. Our IBKR ForecastTraders are pricing in 94% odds of a 25-bp reduction at this week’s meeting followed by a potential pause next month. Indeed, our participants see a 57% probability of a hold at the Fed’s January meeting.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.