Across our US elections articles this year, our macro view has consistently stated that inflation and rates were most vulnerable to one party consolidating power. Any disorderly bear steepening of the yield curve would boost the US dollar (USD) while weighing on equities. Regardless of the election results, we expect fiscal stress to emerge thereafter and the bond market could become a policy constraint in the US.

From a regulatory and broader policy analysis, we had predicted sector dispersion would be narrower than in the previous two cycles. Even so, we consider this to be an opportune way to position for the election, as we would expect market responses to the presidential ticket irrespective of the congressional makeup.

Given the developments on the Democratic side of the ticket, we thought it would be beneficial to provide an update on how the various election outcome scenarios could impact sectors and asset classes.

The Core Scenarios

For clarity, we summarize the four core election outcome scenarios and their impact on policy and regulation in the aftermath of the election. The scenarios are:

- A Republican sweep with full Republican control of all branches of the federal government

- A Trump victory with a split Congress where the Democrats control the House and the Republicans have a majority in the Senate

- A Harris victory with a split Congress as in scenario 2

- A Democrat sweep

In terms of probabilities, we believe that the presidential race remains a coin toss, but that a split Congress is likely (i.e., well above a 50% chance). Between the two tail outcomes, a Republican sweep is much more conceivable than a Democratic one, which we view to be a remote outcome.

Bonds Versus Equities

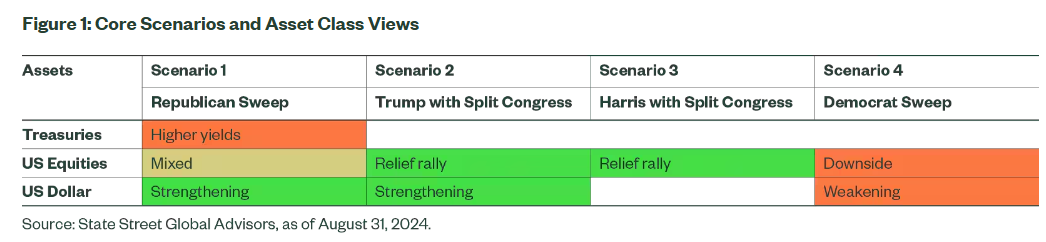

In Figure 1, we highlight the potential impact to Treasuries, US equities, and the US dollar across the various core scenarios. The fiscal-monetary policy mix will largely determine the slope of the yield curve. With the caveat that we anticipate a soft landing and no near-term recession, we foresee the yield curve being driven by macro fundamentals in most election scenarios.

The exception is in the case of a Republican sweep (Scenario 1) as that could deliver a disorderly steepening of the curve by lifting inflation expectations on the back of debt-funded tax cuts, higher tariffs, more restrictive labor market policies, and changes to the governance of the Federal Reserve. Together, these factors could also drive a strengthening of the US dollar despite Trump’s desire to weaken the currency. Equities would likely be volatile as some sectors would benefit from tax cuts and favorable regulatory changes, whereas others would face higher financing costs.

Scenario 2 would include the same regulatory stimulus, but the fiscal picture in our view would be diluted, delivering a more modest currency appreciation and only a slightly steeper yield curve.

In contrast, we would expect the bond market to largely ignore the election in Scenario 3 and perceive it as status quo. In both cases, the stock market would likely be relieved that the election uncertainty was over and rally toward year-end in the typical seasonal pattern.

A Democrat sweep appears to be negative for equities given more expansive regulation and the prospect of material tax increases for both corporations and higher income earners.

Sector Specific Rationales

In 2016, the S&P 500 Index rose a mere 3% in November post the election. Yet, the surprise Trump win prompted a significant 17% dispersion in net returns between the best-performing sector (Financials) and the worst-performing one (Utilities).

In 2020, there was significant sector volatility in the run-up to the election, and following the election, S&P 500 Index returns rose 8% through the end of November with Energy stocks springing with net returns that were 27% ahead of the weakest sector, Utilities.

In 2024, we expect dispersion to be much more contained than in the previous two cycles. Nonetheless, there are notable performance differences that are dependent on the policy backdrop.

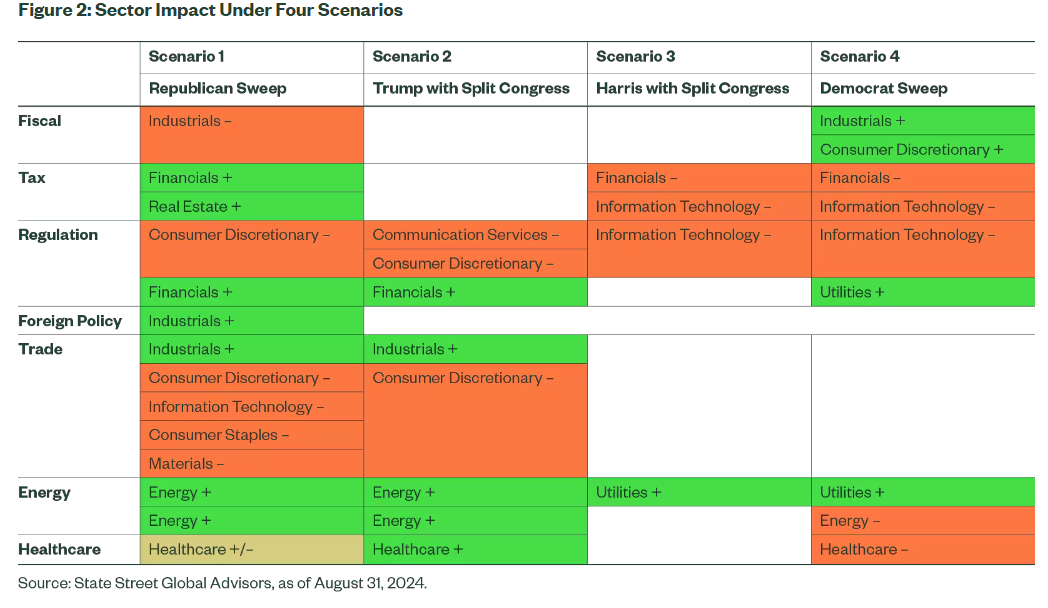

First, either sweep scenario implies changes to fiscal trajectory and the federal tax code (as well as wider fiscal deficits). Trump has called for parts of the Inflation Reduction Act (IRA) spending to be rolled back, something that could undermine the tailwind that Industrials are currently enjoying.

More critically, some elements of the Tax Cuts & Jobs Act (TCJA) introduced under Trump in 2017 are set to expire in 2025. While technically “permanent” at 21%, the corporate income tax rate could see a potential increase, becoming a bargaining chip to finance the extension of other tax breaks (e.g., the top individual tax rate as well as business owner pass-through) – this is something that we consider more probable under a Harris administration.

In 2017, proposed cuts boosted the shares of IT, banks and insurance providers, consumer companies with domestic earnings, and real estate investment trusts (REITs). These sectors could be expected to disproportionately suffer any reversal.

Kamala Harris’s recent outline of tax increases (e.g., an increase of the corporate tax rate from 21% to levels around 25-28%, quadrupling taxes on stock buybacks to 4%, repealing the deduction for foreign-derived intangible income) would bode poorly for the broader equity market, as well as discretionary consumption in the US. However, Harris doubling down on industrial policy would support Industrials.

Regulation: Who Benefits and Who Is at Risk?

A wave of deregulation could be beneficial to Financials, particularly banks, but it would likely be smaller than in the previous Trump administration. Higher rates and a steeper yield curve should be helpful to bank margins, although this could be offset by slower loan growth and higher delinquencies for banks.

Financials and others could also benefit from Republican changes to sustainability investing, with fewer requirements on carbon footprint reporting and limits on the investment industry to develop and market environmental, social, and governance (ESG) products. This would further widen the operational remits between US and European asset managers.

The regulatory path under Harris would mirror that of Biden’s, including continued antitrust measures, though a Democratic Congress would also help tighten rules to pressure companies to decarbonize.

Foreign Policy: Rearmament to Continue?

Our detailed views on the geopolitical spillovers are outlined in a recent article. A Trump presidency is expected to reinforce G7 defense spending growth, benefiting arms contractors. In addition, Trump’s penchant for tariffs on capital goods and likely reshoring would also bolster the competitive position of the Industrials sector, particularly in the US.

Harris’s relatively short tenure in national politics before becoming vice president gives limited insight into her personal foreign policy views. We expect her to maintain the status quo, apart from a possibly less supportive approach to Israel.

Trade: What About Geopolitics?

While tariffs are rising either way, they could be more disorderly with Trump. Expectations of Trump 2.0 include the imposition of punitive trade tariffs on Chinese goods, as well as select tariffs on other net surplus exporters or countries not aligned with the US. The inflationary pass-through overall to headline CPI would be less than 0.5%, but it could mean a hefty price rise for imports in select industries.

Energy: Moving Closer or Further Away From Transition?

Energy originally appeared to be the biggest beneficiary of a Trump election. This still holds true, yet Harris has greatly moderated her energy policy platform and thus the gap is not as large as expected. Potential Republican actions could affect the extension of fossil fuel operations and a pullback on environmental regulation. An expansion in the size and scope of drilling auctions would be relevant to the oil and gas majors and would likely see the US cement its position as the world’s largest producer of crude oil. Energy has fallen recently in tandem with the oil price amid concerns of slowing Chinese and US demand. However, we see tailwinds from both a geopolitical angle and the possibility of higher-for-longer inflation.

Conversely, this scenario could prompt investors to reduce exposure to Utilities, benefiting less from the shift to renewable energy under a Republican-dominated executive. However, Republican support for building new data centres, the requirement for which is growing rapidly with AI-stimulated use, offers upside for electricity demand.

The durability of IRA subsidies and credit remains contested, but on this issue Trump appears to have moderated the risks of cuts to incentives for the manufacturing and ownership of electric vehicles. Such cuts would negatively impact autos, component manufacturers, and charging station suppliers, which predominantly sit within the Consumer Discretionary sector.

Healthcare: A Way to Cut Costs?

This has not been a healthcare-focused election. Even under a unified Republican government, we do not expect the Affordable Care Act to be repealed. Selective threats to the premium tax credits which expire in 2025 and removing coverage for parts of the population are a negative for the managed care names and would put hospitals at greater risk on uncompensated care.

More challenging could be a Democratic sweep where reduced prescription drug prices for Medicare and a cap on the cost of insulin and out-of-pocket drug costs could weigh on pharmaceutical stocks.

The Bottom Line

Identifying sectors that are more likely to benefit from the election outcome is difficult in a tight race. However, there are specific segments that are more election-sensitive. At a sector level, we think changes to the regulatory burden and trade policies carry the most weight. Meanwhile, at the asset class level, the impact on inflation and rates is the key variable. As in the past, investors may implement views by way of sector allocations, both in the US and internationally, in order to optimize portfolios for the outcome of this year’s election.

—

Originally Posted October 1, 2024 – US Elections Finish Line in Sight: Revisiting Our Outlook

Disclosure

Marketing Communication

State Street Global Advisors Worldwide Entities

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The views expressed in this material are the views of Elliot Hentov and Vladimir Gorshkov through the period ended September 30, 2024 and are subject to change based on market and other conditions.

This document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information is from State Street Global Advisors unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Past performance is not a reliable indicator of future performance.

Investing involves risk including the risk of loss of principal.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

For EMEA Distribution: The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

© 2024 State Street Corporation. All Rights Reserved.

7076897.1.1.GBL.RTL

Exp. Date: 10/31/2025

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.