“Slouch” is very descriptive word. As a noun it’s defined as “stand, move, or sit in a lazy, drooping way”, and as a verb it is “a lazy, drooping posture or movement”. (It also rhymes with “couch”, a preferred locale for many a slouch.) At present, I can’t think of a better way to describe stock market volatility.

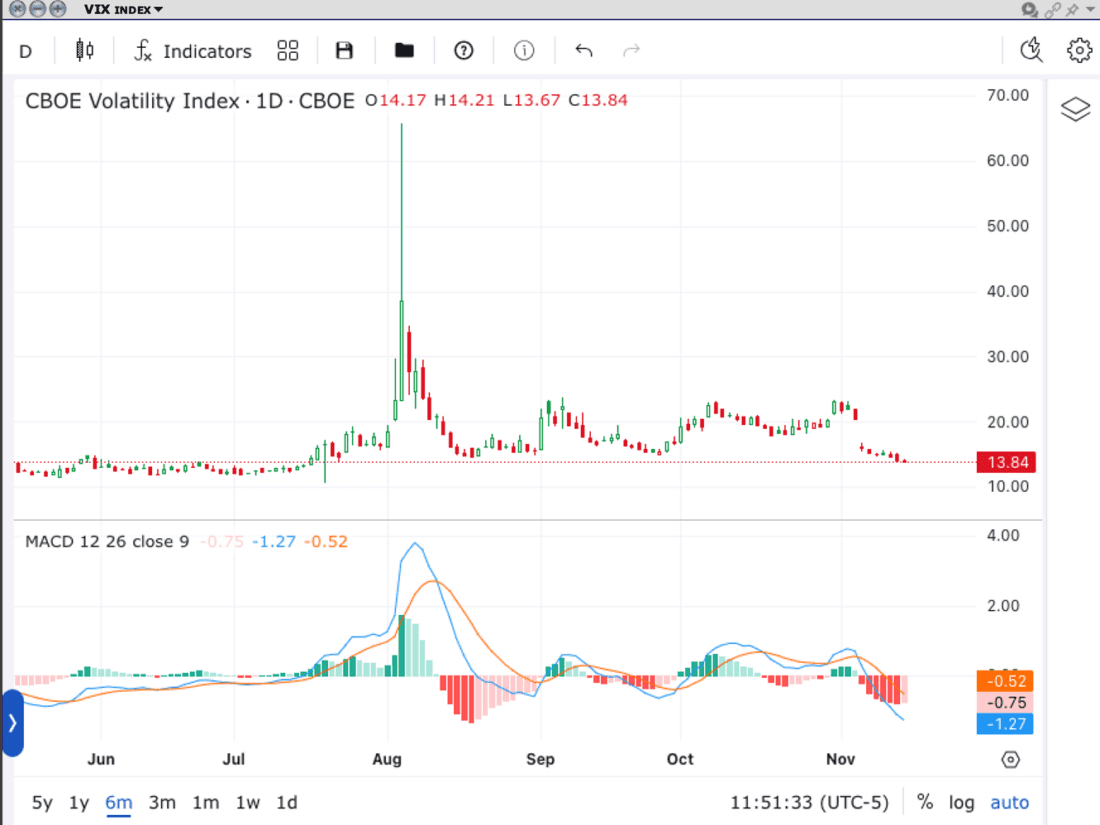

The slouching volatility is reflected in the relatively low level of VIX, the Cboe Volatility Index. As I write this, it has slipped below 14. That is a notable drop from the levels that prevailed from late October through early this month, but also well above its 10.67 low on July 19th.

VIX, 6-Months Daily Candles (top), MACD (12,2 6,9, bottom)

Source: Interactive Brokers (using the new advanced charting feature)

While some commentators have viewed this as a signal that the low level of VIX reflects complacency, I don’t fully subscribe to that notion. Remember,

VIX is not a fear gauge. It just plays one on TV…

This is because VIX is constructed to measure “market expectations of near-term volatility conveyed by S&P Index (SPX) options prices.” The definition makes no mention of fear. Investors tend to expect higher volatility when they are fearful and less when they are sanguine. The former often results in turbulence; the latter in modest, more predictable moves.

Since the VIX calculation utilizes SPX options with 23-37 days until expiration, it made sense for VIX to rise ahead of the election. It was reasonable to expect volatility arising from the election results. And we did in fact get volatility – “socially acceptable volatility.”

Remember, volatility is agnostic – it measures the absolute value of the percentage moves, regardless of direction. Thus, the rallies from Tuesday-Thursday of last week, +1.23%, +2.53%, and +0.74% were indeed the sort of outsize moves that the 20-ish VIX reading anticipated.

It is also normal for traders to expect volatility to diminish when a major anticipated event is in the rear-view mirror. There is simply nothing on the immediate horizon that one could expect to offer the sort of volatility that one might expect from a Presidential election. We see VIX tend to diminish after a key economic event or FOMC meeting, and we certainly see individual stocks’ implied volatilities decline after an earnings report.

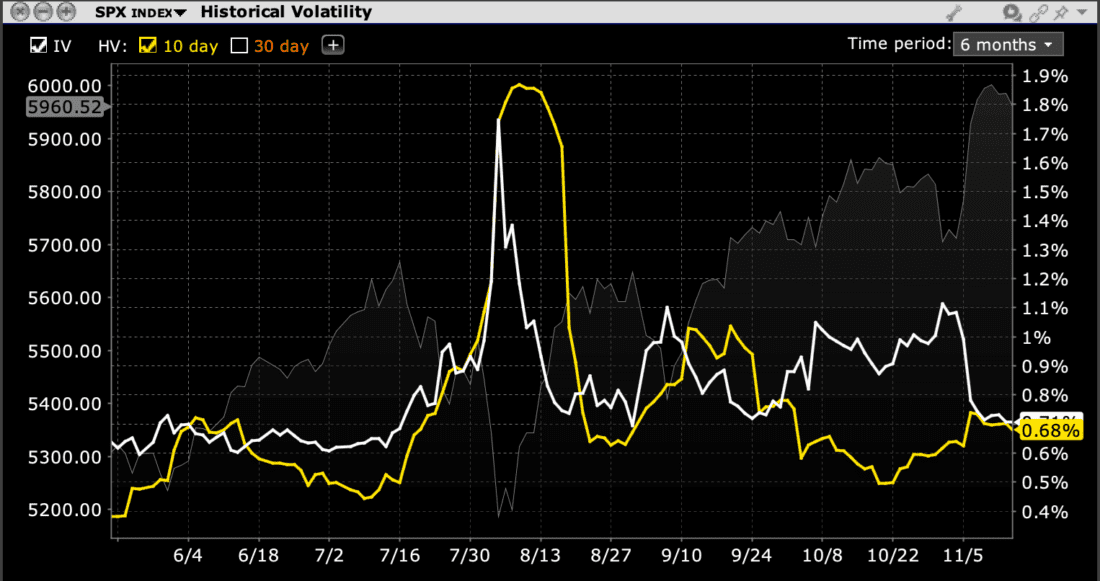

Currently SPX has seemingly gone to sleep, with the past four days offering moves of +0.38%, +0.10%, -0.29%, and +0.02%. With no major events coming soon and SPX engaging in the struggle that major indices often face when trying to breach a major psychological level (like SPX 6,000), it is not surprising that traders have diminished their volatility assumptions. The VIX decline makes sense when we think about it that way. We can see that the 10-day historical volatility for SPX has begun to drop off, and it is reasonable to expect it to drop further if the market remains stable as the post-election volatility is removed from the calculation.

SPX, 6-Months, 10-Day Historical Volatility (yellow), Implied Volatility (white)

Source: Interactive Brokers

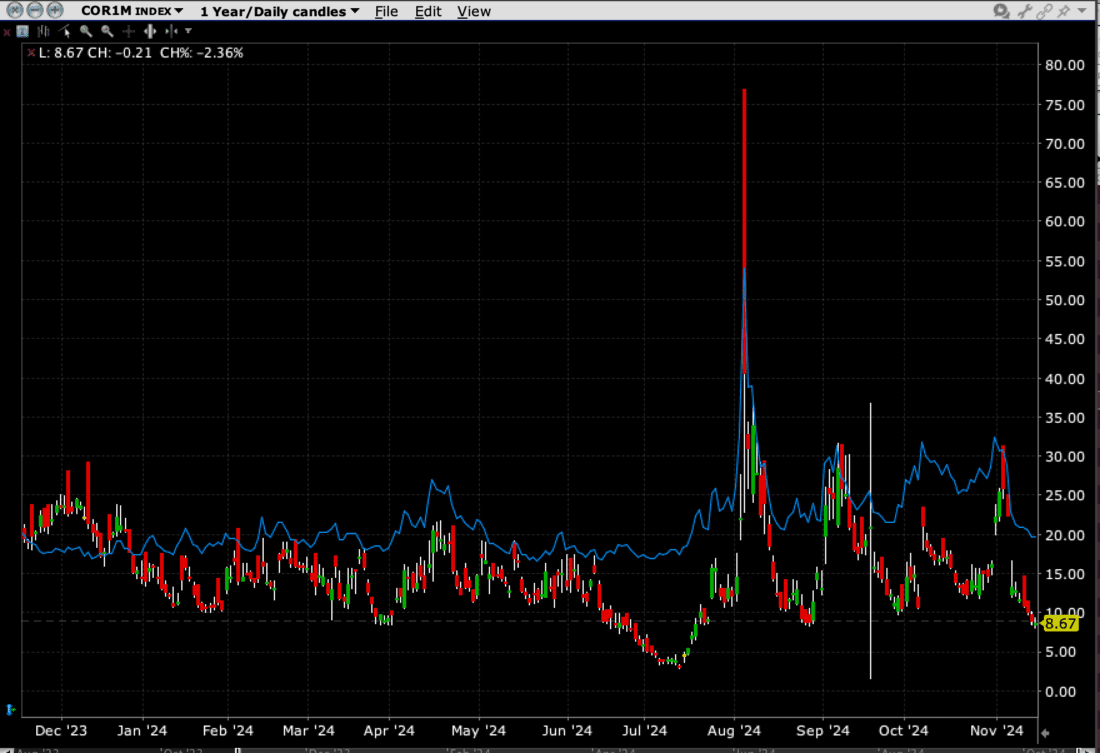

Another factor weighing upon VIX is the lack of correlation between key stocks. It is a good thing to see the markets broaden their focus away from a select group of market leaders, but that means that stocks within the index are moving in different directions. Even on the best days last week we saw advances lead decliners by roughly 2:1 or 3:2. That implies decorrelation, and that adversely affects VIX. (Much more about the relationship between correlations and VIX here)

1-Year, VIX (blue) vs. COR1M Index (red/green)

Source: Interactive Brokers

So, volatility has been indeed a slouch. And to end with a laugh, I’ll quote one of my favorite “slouch” references from the movie “Caddyshack”:

Judge Smails: You know, you should play with Dr. Beeper and myself. I mean, he’s been club champion for three years running, and I’m no slouch myself.

Ty Webb: Don’t sell yourself, short Judge, you’re a tremendous slouch.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ