A huge market uncertainty is removed … Louis Navellier says the “turbo boost” is here … why Luke Lango believes it’s 1998 again … a trading course from a pro

In yesterday’s Digest, we provided our take on the Fed’s 50-basis-point rate cut as we begin the first rate-cutting cycle since 2020.

Today, let’s get the insights from two of our experts.

We’ll start with legendary investor Louis Navellier and yesterday’s Flash Alert podcast in Growth Investor:

The Fed came in and cut the key interest rates 50 basis points. There was one dissenting vote – the first dissenting vote on the Fed since 2005…

The Fed also signaled that they will be cutting another 50 basis points this year. So that’s probably 25 basis points at their November FOMC meeting and another 25 basis points at the December FOMC meeting. Then another three quarters of a percent rate cuts in 2025.

So, incredibly bullish.

Over in Louis’ Weekly Update in AI Advantage, he provided more color on how the Fed is balancing the waning risks of inflation with the waxing risks of the jobs market:

Now, for months, it was assumed that the Fed would “play it safe” and cut key interest rates by 0.25%. But as the inflation data got better – and the labor data got worse – the calls were growing louder for a 0.5% cut…

The Fed is no longer worried about inflation. The Fed’s preferred inflation measure – the core component of the Personal Consumption Expenditures (PCE) index – has been running at an annual pace of 1.7% over the past three months. And that is well within the Fed’s 2% annual target.

The reality is that its goal of reaching 2% inflation is nearly met. In fact, Fed officials project a 2.6% inflation rate at the end of the year and 2.2% next year.

Instead, the concern now is about the jobs market. The unemployment rate has ticked up to 4.2%, up significantly from 3.4% just 16 months ago.

Jumping back to Louis’ podcast, he made the point that yesterday’s decision removes a major uncertainty overhang from the market. The only remaining question mark is the presidential election.

However, despite the possibility for volatility that November 5th presents, Louis’ bottom line is bullish:

We’ll see how it all shakes out, and we’ve got long ways to go [until the election] …but we look at [yesterday’s Fed news as] unbelievably bullish.

So, enjoy the ride folks. This was very, very impressive… I do think this was an incredibly bullish event…

Bottom line, these rate cuts will serve as the long-awaited “turbo boost” to not only the stock market but the U.S. economy as well.

Our hypergrowth expert Luke Lango shares Louis’ optimism

In yesterday’s issue of Hypergrowth Investing, Luke began by commenting on the size of the cut:

The big news here, of course, is that the Fed has cut interest rates by a whopping 50 basis points (bps). That’s uncommon.

Typically, the central bank cuts in 25-bp increments. Jumbo 50-bp moves are rare, typically reserved for when the Fed wants to really support the economy.

In other words, with [yesterday’s] jumbo cut, the central bank is making it clear that the U.S. economy has its full support…

Luke’s bullishness extended to his analysis of Federal Reserve Chairman Jerome Powell and his live Q&A comments:

And in the bank’s post-meeting press conference, Fed Board Chair Jerome Powell sounded very dovish. He expressed that if the economy begins to weaken unexpectedly, the Fed will cut rates even more aggressively than it’s forecasted.

As to the impact on stocks and the economy, Luke didn’t hold back:

In our view, this bold move opens the door for stocks to party like it’s the 1990s all over again.

Behind Luke’s bullishness isn’t just yesterday’s rate cut, it’s the succession of cuts that the Fed highlighted on its Dot Plot

As we noted in yesterday’s Digest, the Dot Plot is a graphical representation reflecting each committee member’s anonymous projection of where they believe rates will be at specific dates in the future. The Fed members update the Dot Plot once every three months.

Here’s Luke’s economic/market prediction based on the updated Dot Plot:

As the ‘dot plot’ shows, the Fed will cut rates consistently over the next one to two years.

Indeed, in its updated Summary of Economic Projections, the Fed pointed to more rate cuts this year… more rate cuts next year… and more cuts the year after that. In total, the Federal Reserve is projecting another seven to eight rate cuts over the next two years.

Collectively, those cuts will help to reinvigorate the economy.

Mortgage rates will crash, reenergizing sidelined homebuying demand and unfreezing the housing market. Auto financing rates will plummet, too, reheating the stalled-out auto market. And debt costs will fall, prompting both individuals and institutions to borrow and spend more money.

In other words, it seems the economy is about to bounce back in a big way. As it does, the markets should, too.

Zeroing in on stocks, Luke believes we’re now headed for a melt-up paralleling what we saw in 1997/1998

Older investors will recall the late 1990s when the economy and the market were performing well, powered by internet tech stocks. However, beginning in the summer of 1998, the economy began to slow.

Stocks, which always look ahead, began selling off, fearing a recession. In response, the Fed rode to the rescue with rate cuts.

Here’s Luke with the result and the parallel to today’s market environment:

Over the next 18 months, stocks – led by tech stocks – absolutely soared. The Nasdaq 100 actually rallied more than 300% from trough to peak (late 1998 to early 2000).

And it appears history is repeating right now.

Throughout 2023 and ‘24, the stock market and economy performed well, partly powered by AI investment tailwinds. Then, in the summer of 2024, the economy started to slow, and the stock market began losing its footing.

The Fed has ridden to the rescue with rate cuts…

We expect that over the next 18 months, stocks should soar – paced by tech stocks.

Therefore, we are walking away from [yesterday’s] Fed meeting feeling very bullish.

Luke clarifies that this doesn’t mean we should expect consistent bullishness with no downside

As I write Thursday morning, stocks are exploding higher. But history suggests we should prepare for more short-term volatility.

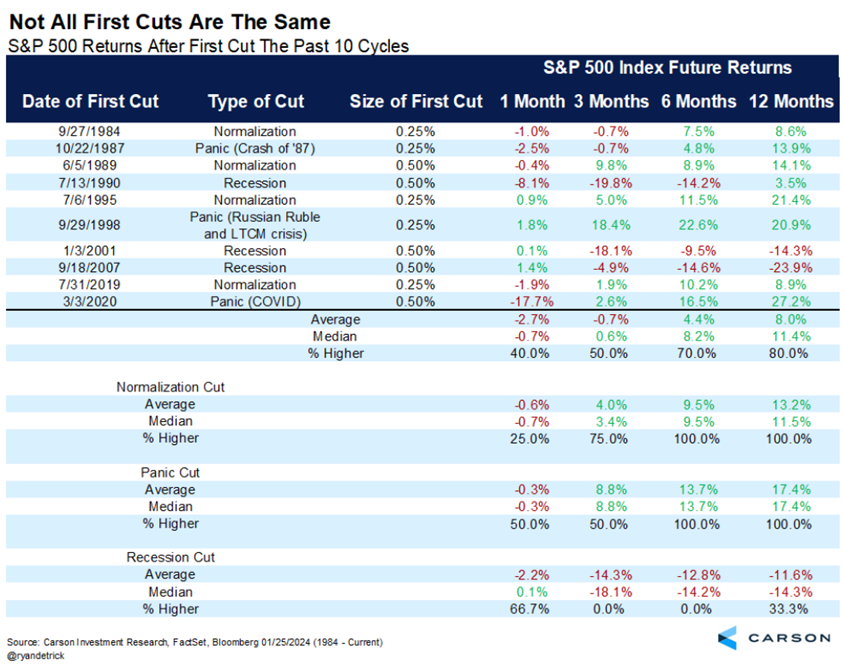

Per usual, Luke ran the numbers, looking at historical market data in the wake of rate cuts. What he found was that – despite today’s gains – we often see negative performance from stocks within the first month after the Fed begins rate cuts.

But Luke urges his readers not to misinterpret. As long as we avoid a recession, the market’s performance beyond that first month has been positive:

Here’s Luke’s chart with those details. The market’s three-, six-, and 12-month periods all turn positive when the economy avoids a recession:

Putting it altogether, both Louis and Luke are walking away from yesterday’s rate cuts with one primary takeaway – get bullish

But I’ll let Luke make that point directly:

Folks, we think the greenest of shoots may lie ahead.

The next 12 to 24 months could prove to be fantastic for the markets… especially so for tech and AI stocks.

The bulk of evidence suggests that we will get the ultra-powerful, ultra-rare combination of falling interest rates and rising earnings over the next few years.

So long as that dynamic persists, stocks should keep pushing higher, led by those with the biggest earnings growth – which, as of now and likely for the foreseeable future, are technology stocks…

Let’s get ready for that rally and pile into AI stocks with the highest upside potential out there.

Before we sign off, a quick note…

Regular Digest readers know that I frequently distinguish between longer-term investing and shorter-term trading. I believe there’s significant money to be made right now with trading thanks to the Fed.

But if you’re not 100% sure how to do that exactly, today, you have a fantastic opportunity.

Master trader Jonathan Rose is offering a 5-Day Options Trading Challenge. If you’re new to options and trading, this is for you. It’s a learning course, and Jonathan is one of the best teachers in the business.

From Jonathan:

When I first went public with my three-step options strategy, I had one goal:

To change the financial lives of ordinary people.

Over the last decade, I’ve taught over 50,000 folks across America how to use my strategy.

So… does it really work?

Take a look:

“This is a whole new world to me. Invested in equities all my life but never options. Even with small trades [I’m already up $2K] … didn’t think it would happen that quickly!

— Larry L.

“I would like to sincerely thank you Jonathan. Your approach is unique and your daily involvement and commitment is unmatched. As my skills improve, I expect my portfolio to grow to the size I have always hoped for. You have finally given me hope of achieving some financial success.”

— Rick M.

“Just closed [a trade that] I would have closed in the past for 150% return… for 300% return instead… as you always say Jonathan, education makes the difference!”

— Michael C.

Bottom line: If you want to trade this market but are new to trading, or just want some expert guidance, I’m confident Jonathan’s course can help.

Have a good evening,

Jeff Remsburg