Retiring baby boomers in many countries will mean fewer workers, forcing companies to turn to robotics, automation and AI, with many potential investment implications.

As baby boomers retire, the working age populations in many of the world’s largest economies is forecast to begin contracting.

The result will be fewer available workers, weighing on growth and exacerbating inflationary trends in the global economy.

Source: Schroders

That’s why demographics is one of the “3Ds” we see as shaping a new economic regime. Major shifts in the three areas of demographics, deglobalisation and decarbonisation are driving a 3D Reset.

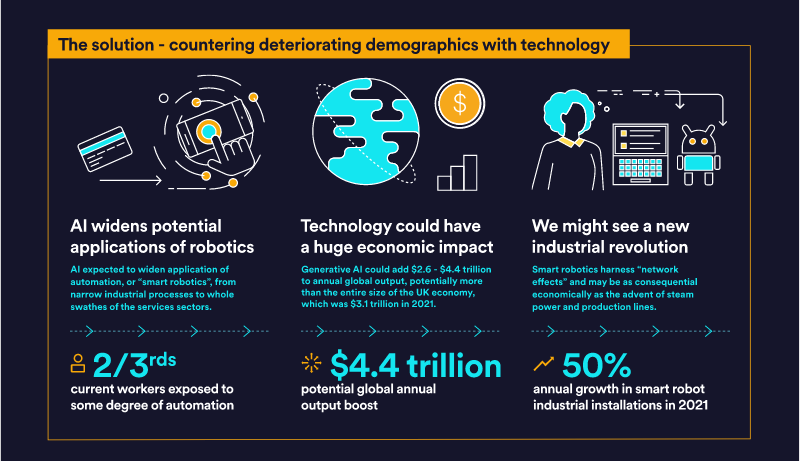

How companies respond and the investment implications

How companies and policymakers, whether governments or central banks, respond to the 3D Reset will be crucial to understand.

Less supportive globalisation trends linked to rising protectionism, will limit the response to demographics through the relaxation of immigration controls, for instance.

Azad Zangana, Senior European Economist and Strategist, says:

“The rise of populist politics has meant that populations are less willing to allow migrants to come in and fill roles, so companies are having to think of alternative solutions to the labour shortages.

“The shortage of workers will force companies to begin to make greater use of robotics, automation and AI in order to manage their rising costs.”

There are many uncertainties around the investment implications, not least due to the speed of change.

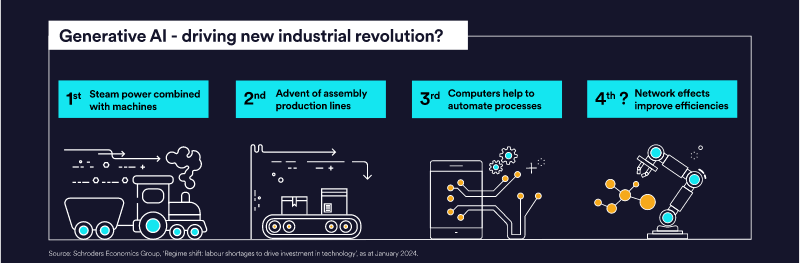

Where previous industrial revolutions took decades to create large scale impact, AI-first companies are registering that impact in months.

But investors are seeing some clear “second-order” impacts from AI trends which are set to touch many industries.

Source: Schroders

Nils Rode, Chief Investment Officer, Schroders Capital, says:

“The AI revolution is driven by venture capital backed start-ups, so venture/growth capital is the place to be for investors who want to get direct exposure to this mega theme.

“Additionally, we expect the impacts of AI to have second-order impacts on the real estate and infrastructure markets.

“The substantial data processing requirements and the production of even more data through AI is giving a further boost to demand for data centres, creating tailwinds in this area.

“Furthermore, AI’s massive compute appetite needs substantial energy resources, that we see as an opportunity for infrastructure investments, particularly in renewable energy.”

Daniel McFetrich, Head of Global and International Equity Research, says:

“We are witnessing a multi-year transformation of factories, warehouses and industrial assets.

“This will revolutionise not just how we manufacture, but also how we distribute, design and monitor assets in the field.

“The increasingly quick paybacks on these investments, faster and more reliable communications networks, and ageing demographics all mean the desire and need to invest is accelerating now.”

To view the full infographic click here

—

Originally Posted February 20, 2024 – Infographic: will shrinking workforces spark a new industrial revolution?

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.